AFRICA, Article, FEATURED STORIES, WORLD

Peril Of China’s ‘Death-Trap Loans’ To African Countries

China has emerged as the biggest African trading partners and has become deeply involved African politics

Africa has become a pristine destination for many African countries seeking loans to fix infrastructural deficits and other developmental challenges—a trend with many downsides than prospects.

Africa is not new to colonialism. Though in different forms—African countries share a similar history of slavery, subjugation and attendant pilfering of human and natural resources in the hands of the so-called colonial powers.

This, arguably, is still being singled out for the continent’s snail-paced development in some quarters—a narrative that mostly considered a form of escapism by the continent’s leaders, given the rise of Indian and other countries that earlier grappled with one form of colonialism or the other.

Yet, most African countries seemed not to have learned anything from its dark days of colonialism with its new-found romance with China.

Various economic indices are pointing to the fact that Africa is sitting on a keg of powder over its choice of China for loans.

The China option for Africa

China is unarguably one of the world’s emerging economic superpowers, challenging the US and Europe. Its evolution has been a subject of discourse among policymakers in various countries across the globe—developed and developing nations.

Africa countries seem to be facilitating China’s emancipation as a powerful nation, though, at its own detriment. With huge natural resources—human, natural—and a booming market, Africa has become a major target for China to further advance its technological and economic grip on the global landscape.

This is happening at an immeasurable cost to Africa. A critical look at China’s relationship with Africa shows it has been more parasitic than symbiotic.

Africa is confronted with various challenges—leadership failures, technological backwardness, struggling economies, corruption among others. These challenges, to a large extent, have been advantageous for China, aiding its penetration into Africa and consequent grips on the continent.

By offering itself as a short term solution to the continent’s numerous challenges, China has recorded a huge success in making African countries its dumping ground for its products and services—while claiming to be the continent’s partner for economic development.

China’s loans to Africa and growing criticisms

China’s loans to African countries are now often viewed through a negative lens than positive due to many reasons. First of such is the lack of transparency associated with its loans to Africa. In a continent where corruption holds sway, the lack of transparency that often accompanies such heavy loans promote impunity among the leaders—creating little room for assessment of public accountability and scrutiny.

Expectedly, however, China has defended its opaque approach in granting overseas loans. A report by the National Bureau of Economic Research tagged ‘China’s overseas lending,’ provides an insight into why the country’s overseas lending had remained obscured.

“The main challenge to explore China’s large-scale official lending boom is its opacity. Unlike the United States, the Chinese government does not release data on its lending activities abroad or those of its government entities. Moreover, China is not a member of the most important creditor organizations that provide data on official lending and restructurings, in particular, the Paris Club of creditor governments but also the OECD.

“No data is therefore available from the creditor side. On the debtor side, the data coverage on Chinese lending is highly incomplete as well. One reason is the way in which the Chinese government lends abroad. The credits are rarely borrowed bilaterally, i.e. government-to-government. Instead, almost all of China’s overseas lending is extended via Chinese state-owned entities and the recipients also tend to be state-owned enterprises.

“This type of company-to-company lending is often not collected by the statistical offices of developing countries so that international debt statistics suffer from chronic underreporting. According to the IMF, fewer than one in ten low-income countries report debts of public corporations that are outside the general government (IMF 2018). As a result, the debtor countries themselves have an incomplete picture of how much they have borrowed from China and under which conditions.”

Beyond China’s opacity, its predatory intend with loans to Africa has also attracted scrutiny. With its death-trap diplomacy with Africa, many countries in the continent are under intense pressure to part with their prized assets over the inability to pay accumulated debts incurred from loans obtained from China.

The death-trap diplomacy: Africa and the Sri Lanka-esque experience with China

The most obvious of China’s growing influence in Africa is its death-trap diplomacy with the continent. Through this means, China—overtly and covertly—cough out huge loans, accompanied by a huge high-interest rate, to Africa to meet its infrastructure and other deficits using agreed collateral, which is usually a national asset.

In the end, China ends up taking over such assets when the debtor countries failed to repay the loans granted to them. This trend is taking root in Africa, even though the continent’s leaders either seemed ignorant of their actions or knowingly pursuing such loans for personal aggrandizements.

China is showing no reservations in granting loans in Africa, a ploy that only strengthens claims of its exploitative intent in the continent.

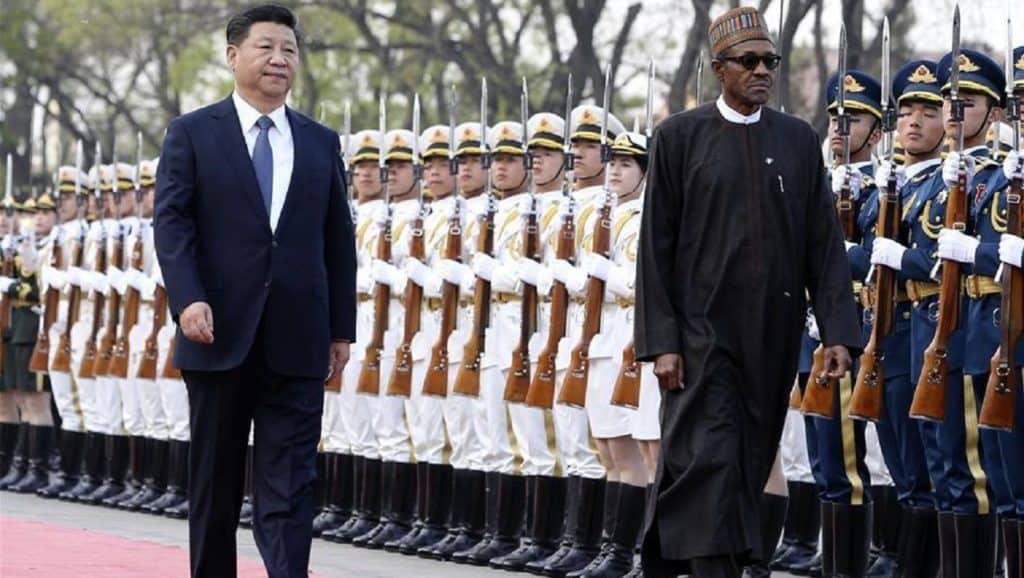

President, Xi Jinping, seems to be pursuing more bilateral relations with Africa in recent times. In 2015, for instance, his country provided Africa with a whopping $60 billion loan in Beijing. In 2018, Jinping further committed his country’s economic interest in Africa with another $60 billion during a summit with leaders from the continent.

The evidence of such unrestricted donations to African countries is conspicuous, with China boasting over 1,000 firms operating in Africa—to position itself as one of the drivers of the continent’s economy with significant influence on trade, investment infrastructure financing, and aid donation.

Sri Lanka has become a fulcrum around which most controversies on China’s ceaseless, predatory loans to Africa revolve, for the infamous concession of its major port to China over the inability to repay $8 billion.

However, emerging reality from various African countries shows a similar trend is fast taking root across the continent.

The Zambian government has had a tumultuous ride dispelling thickening claims China had taken over its Zambian National Broadcasting Commission (ZNBC) and the Kenneth Kaunda International Airport alongside other public assets over a loan default. Regardless, the media have been inundated with several such reports, showing the government could yet be under pressure to part-way with some of its valued assets. Such narratives are proving difficult to quash given the nation’s threatening debt record.

Madagascar was also enmeshed in a similar web by parting with a huge chunk of its land as collateral for loans taken from China. The story is also the same as the Democratic Republic of Congo (DRC)—one of Africa’s most indebted nations to Chinese loans.

Djibouti is another African country in a similar hook. The country reportedly coughed out its port—one of its major public assets after China loans accounted for 82% of its total external debt.

In Nigeria, Africa’s most populous nation, the country has found a renewed romance with China under the administration of President Muhammadu Buhari. With depleting oil revenues—which is the major driver of the country’s economic growth—Nigeria’s economy has witnessed significant challenges in meeting the needs of its teeming population.

Several attempts to diversify the economy have been greeted with challenges of various kinds ranging from poor infrastructure, corruption, and improper management. The alternative, it seemed, has been an unchecked borrowing—notably from China—which only endangers the country’s future.

More so, much of the government’s borrowings have largely been used for debt servicing—a model, expert says is economically unsustainable. The president recently presented the 2020 Appropriation bill before the National Assembly—the country’s legislative chamber—for consideration and consequent passage.

A review of the content of the budget dents any hope of economic prosperity for Nigeria. A quarter of the budget presented for deliberation of the lawmakers is estimated to be used for servicing local and international debts.

“Nigeria’s borrowing is frightening. Although some economists have argued that with our revenue income and economic outlook, we have the capacity to sustain the economy even in the borrowing,” Mr. Ambrose Igboke, a Lagos-based public affairs analyst, told CARACAL REPORTS.

“But the question is why should we even be borrowing at this rate when the present government claims a lot have been recovered through the use of Treasury Single Account (TSA).

“And when we are borrowing, we are not investing them into the appropriate sectors. The fear is that most of these borrowings are not for capital expenditure, they are not for infrastructural development, they are not used for critical sectors of the economy, they are not used for housing, they are not used for education, they are not used for health, they are not used for road, they are not used for critical interventions.

“What they are being used for most of the time is current expenditure. The Paris Funds, London Funds among others are mostly used to pay salaries. We are borrowing to pay salaries; we are borrowing to run the offices for administrative purposes. Some countries like the United States that borrow are borrowing to fund critical infrastructure. They are funding Information Communication Technology (ICT), they are funding super-highways. But in Nigeria, our education sector is comatose, our healthcare system is in shambles and yet we are borrowing to pay salaries. So, Nigeria is a country that is supposed to look inward, that is supposed to tap into our natural resources and make money.”

Like other African countries, China has registered itself as the go-to economic partner in obtaining loans for Nigeria. Execution of the country’s major infrastructural projects has also been largely left at the hands of many Chinese firms at the detriment of many jobless Nigerians.

If not anything, Africa needs to check its unbridled knack for loans from China for a singular reason: The dangers inherent in such loans far outweigh the gains.