Article, FEATURED STORIES, news, Politics, U.S.

Panic for Profit: Activist Uncovers Pritzker Conflict of Interests

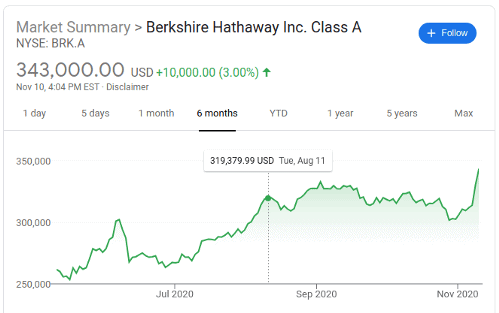

Berkshire Hathaway stock with a noted spike as utility shutoffs were scheduled to resume.

- Allan Max Axelrod and the #NoAmerenShutoffs campaign have made major progress in the fight to keep utilities on for the people of Illinois during the pandemic.

- The state is surging in Covid-19 cases and mortalities while Governor JB Pritzker remains silent on extending an eviction moratorium and enacting a mandatory moratorium on utility shutoffs.

- Axelrod uncovered that Pritzker has a business history with Warren Buffet and Berkshire Hathaway, in which the governor reported owning stock in 2017. That stock, along with that of other corporate utility companies, has benefited from utility shutoffs in Illinois during the pandemic.

- In light of this information, will Pritzker tell the people of Illinois where his current stock interests lie?

As previously chronicled by Caracal Reports, activists in Illinois have been working diligently to achieve a statewide mandated moratorium on utility shutoffs.

Allan Max Axelrod and the #NoAmerenShutoffs campaign have been instrumental in passing multiple resolutions that define utility service terminations as a pandemic safety risk. They have repeatedly called on Illinois Governor JB Pritzker to employ his emergency powers to put an end to shutoffs.

Despite a record-setting increase in Covid-19 cases in Illinois, Pritzker has refused to take action beyond a voluntary moratorium. He has been an immovable obstacle to progress for those struggling through pandemic hardships in his state.

As noted on the Twitter of Central Illinois News, residents of the state are now losing eviction protections. Pritzker is receiving calls to extend the eviction moratorium and finally enact a mandatory moratorium on utility shutoffs.

Pritzker’s shutoff panic: 48,000 utility shutoffs in Illinois in October

In correspondence with Caracal Reports, Axelrod noted that utility companies in Illinois reported more than 48,000 utility services were disconnected in October, according to company compliance reports. At the same time, the state was suffering a rapidly increasing daily record in cases of Covid-19.

The current surge is the worst the state has seen since the start of the pandemic and puts Illinois among the states with the highest deaths per capita.

The governor of such an ill state as Illinois holds much responsibility, but Pritzker has refused to use powers that only he possesses.

The Urbana City Council and Mayor Diane Wolfe Marlin recently urged Pritzker to treat utility disconnections as a pandemic safety risk. The council passed a resolution which read, “the Governor of Illinois has the authority from 20 ILCS 3305 Sec 7 (12) to enact a mandatory moratorium on utility disconnections”.

In response, Pritzker falsely claimed to the press that he lacked “the ability to simply put a moratorium in place,” as suggested. A local journalist then fact-checked him on air.

Pritzker has since been silent on shutoffs and moratoriums while virus spread in Illinois has boosted hospitalizations to an all-time high.

JB Pritzker: America’s wealthiest politician

Pritzker is far from the only leader refusing to enact a protective mandate to regulate corporations. However, Axelrod recently uncovered a past deal and stock holdings, which may have a questionable influence on his actions.

In an article for United Left, Axelrod outlined the discovery, catalyzed by work as the campaign lead for #NoAmerenShutoffs. He connected the dots back to 2007 when Warren Buffett’s Berkshire Hathaway purchased roughly 60% of Marmon Holdings, Inc., “a global industrial organization” started in 1953 by Jay and Robert Pritzker.

Those men were JB Pritzker’s uncles, and when Marmon Holdings was split between 11 Pritzker relatives, JB was among them.

The Omaha World-Herald reported in 2017 that a large percentage of Marmon Holdings was initially purchased by Berkshire Hathaway for $4.5 billion. Then, smaller payments of about $1.4 billion ebbed out over five or six years to buy up most of what parts of Marmon remained with the Pritzkers.

The sale amount was estimated at a total of up to $9.2 billion by 2013. Even split 11 ways, it was a highly valuable profit for each of the already incredibly wealthy cousins.

Currently, JB Pritzker is worth more than 3.4 billion dollars and America’s richest politician, according to Forbes. He was also included on the Forbes 400 for 2020, a list of America’s richest people, “pandemic be damned.”

Conflict of wealthy interests

Axelrod found a glaring conflict of interest disclosed in Pritzker’s 2017 Statement of Economic Interests for his gubernatorial campaign, where he reported owning stock in Berkshire Hathaway.

The company was listed on multiple pages of the disclosure in response to questions which asked for:

- “the name and instrument of ownership in any entity doing business in the State of Illinois, in which the ownership interest held by the person at the date of filing is in excess of $5,000 fair market value or from which dividends in excess of $1,200 were derived during the preceding calendar year.”

- “the identity (including the address or legal description of real estate) of any capital asset from which a capital gain of $5,000 or more was realized during the preceding calendar year.”

- “the name of any entity doing business in the State of Illinois from which income in excess of $1,200 was derived during the preceding calendar year, other than for professional services.”

It is unknown if Pritzker still owns these stocks, but Axelrod pointed out that further conflict is found in companies owned by Berkshire Hathaway if he does.

One example is MidAmerican Energy, an electric and natural gas corporation which serves Illinois but refused to take part in Pritzker’s voluntary moratorium. Furthermore, Berkshire Hathaway owns Burlington Northern Santa Fe Corp., which transports coal to Illinois power companies.

Axelrod followed the stock values of Ameren Corp., a power company, and Buffett’s Berkshire Hathaway. He noted a similarity between the companies’ spikes in stocks, which could be related to dates of utility service disconnections and notices.

Creating the fear of shutoffs appears to be good for Ameren Corp. and Berkshire Hathaway stocks, but what about Pritzker? Has the governor been making himself richer along with Buffett and Illinois utility companies?

The history of buying and selling companies and stock between Pritzker and Buffett is not suspicious on its own, as that seems to be something ultra-wealthy people do freely. It does become suspect because Pritzker is the governor and fails to save his state while Buffett and others profit from the panic.

Of course, the governor needs to balance interests, but if those interests ever include his own stock benefits or those of old business acquaintances, they are clearly conflicted.

What’s next for #NoAmerenShutoffs

In the chaotic present, Axelrod and #NoAmerenShutoffs will continue to push Pritzker to do what is right for the people of Illinois.

In the United Left article, Axelrod wrote that “utility shutoffs are a pandemic safety risk, and utility service continuation is explicitly enumerated as a priority” in a 2007 Congressional Research Service report for Congress.

Axelrod noted that at the time of the article’s writing, #NoAmerenShutoffs had achieved:

- “resolutions through the Macon, Champaign, and McDonough Champaign County all calling on the Governor to stop utility shutoffs.”

- “a resolution, unanimously, through City of Urbana also calling on the Governor to stop utility shutoffs.”

- “a water shutoffs moratorium as well as a tabling of a business deal with Ameren Illinois.”

Furthermore, a letter was released “with signatories including members of the Illinois General Assembly and local officials all calling on Governor Pritzker to act.”

According to Axelrod, despite having all of this information, Pritzker most recently claimed to be balancing interests, like those of landlords.

The governor remains silent and inactive on extending any further pandemic protections for the people of Illinois, as Covid-19 spikes along with stock in corporate utilities.

UPDATED: Nov. 17, 2020 at 10:17 PM — Axelrod made Caracal Reports aware that the Illinois Department of Insurance has announced fines for two former subsidiaries of Berkshire Hathaway. Although the companies were owned by Berkshire Hathaway at the time of a 2019 market conduct examination, Buffett sold his reported 81% of the company’s stock last October.

A press release stated, “Continental Indemnity Company and Applied Underwriters Inc., both subsidiaries of Berkshire Hathaway at the time of the investigation, were selling a workers’ comp product with an unlawful side agreement that changed the obligations of the employer under the policy.”

The companies will pay $250,000 to Illinois but “also paid fines for selling similar products in other states, including California, New Jersey and New York” while under the ownership of Buffett and Berkshire Hathaway.

CORRECTION: On Nov. 13, Gov. Pritzker announced an extension on a housing eviction moratorium through Dec. 12 for qualifying Illinois residents.