Business, FEATURED STORIES, Finance, news, Politics, TRENDING, U.S.

Four Senators Sold Stocks Before Market Crashes After Private Coronavirus Briefing

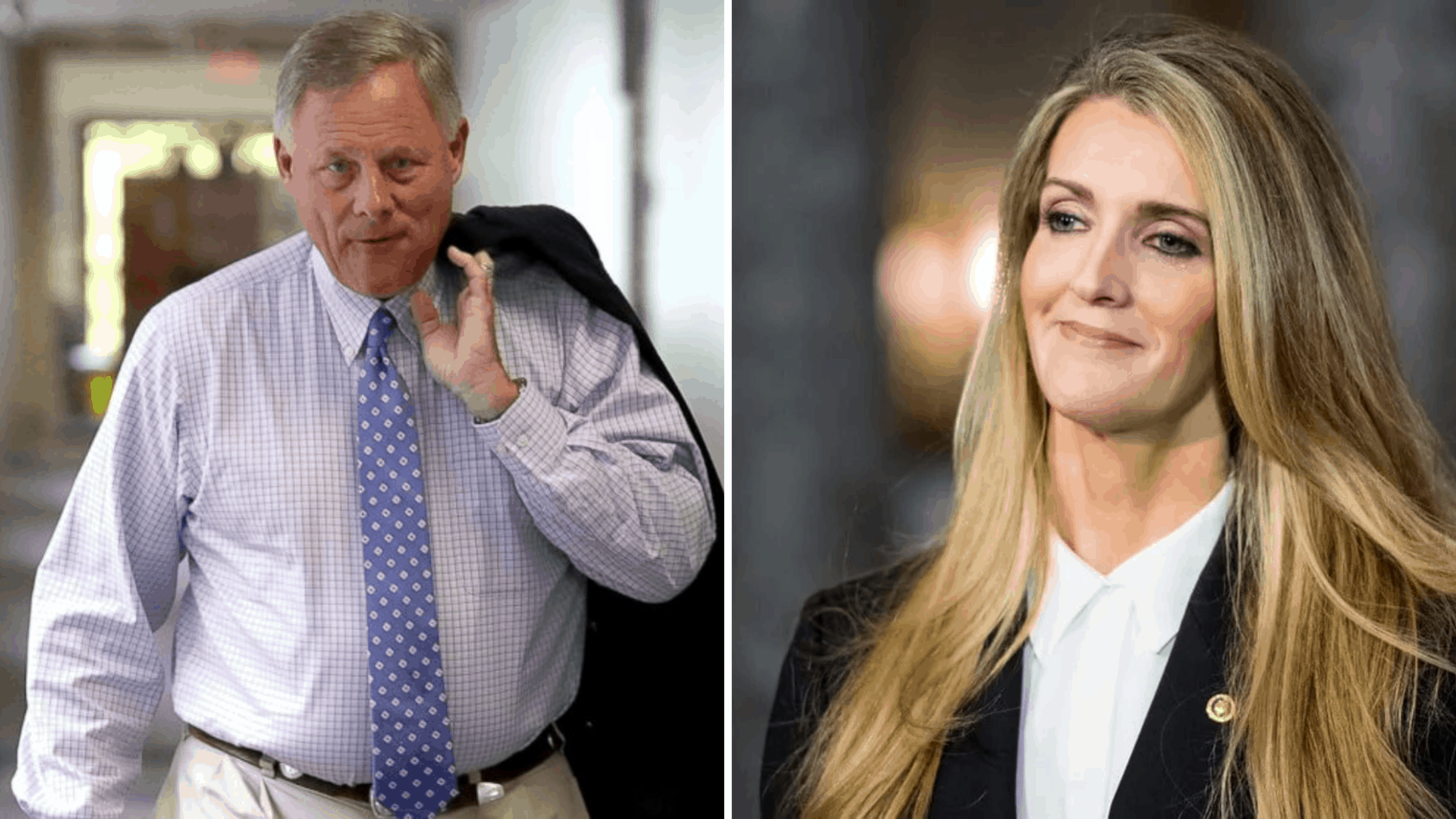

Senators Richard Burr (left) and Kelly Loeffler (right) (images courtesy ABC and The Daily Beast)

Four Senators are accused of selling individual stocks in companies that plummeted during the recent market crash caused by COVID-19. The Senators received a private briefing on January 24 about the novel coronavirus, prior to the sales taking place.

The four Senators are Richard Burr (RNC), Diane Feinstein (D-CA), James Inhofe (R-OK), and Kelly Loeffler (R-GA).

Since the sell-off, the markets have contracted 30 percent, leading to the worst week for the market in decades, and returning to levels last seen at the beginning of Trump’s presidency. The crash has devastated 401ks across the country, and led to hundreds of thousands of lost jobs as businesses close their doors to comply with social distancing measures.

The sales may be in violation of the 2012 STOCK Act, which explicitly outlaws insider trading among government officials.

Here’s what we know about the actions taken by the four Senators.

Sen. Richard Burr

Senator Burr is accused of publicly downplaying the seriousness of the economic threat caused by the novel coronavirus publicly, while privately warning well-connected constituents and dumping investments. He currently serves as the chairman of the Senate Intelligence Committee.

On January 24, Burr attended the Senate Health Committee briefing on the coronavirus.

On February 7, Burr co-authored an op-ed in Fox about the preparedness of the country to fight the virus. “Thankfully,” he wrote, “The United States today is better prepared than ever before to face emerging public health threats, like the coronavirus, in large part due to the work of the Senate Health Committee, Congress, and the Trump Administration.”

The article downplayed the threat and attempted to assure the public that the government had things under control.

On February 27, however, Burr attended a private luncheon with the Tar Heel Circle, a club of well-connected constituents. There, he issued a dire warning in stark contrast to his previous message. According to NPR, which obtained a secret recording of Burr’s comments to the club, “Membership to join the Tar Heel Circle costs between $500 and $10,000” and promises connections to government officials.

In his statement to the club, Burr warned that travel should be shut down, schools closed, and that the virus was, “more aggressive in its transmission than anything that we have seen in recent history.” He also warned of military intervention, three weeks before the public became aware of the potential mobilization.

As of March 5, however, he was still publicly stating, “we have a framework in place that has put us in a better position than any other country to respond to a public health threat.”

On February 13, the New York Times reports that Burr sold “hundreds of thousands of dollars’ worth of stock in major companies”—less than a week after his op-ed was published. This was the most stock he had sold at once in over a year.

Burr and his wife reportedly sold 33 different stocks worth between $628,000 to $1.7 million. A large portion of those stocks were in the hotel, hospitality, and travel industries. They included Wyndham Hotels and Resorts and Extended Stay America—some of the worst-hit by COVID-19.

According to ProPublica, who broke the story, Burr was one of only three Senators to oppose the 2012 STOCK Act. The Act explicitly prevents lawmakers and their staff “from using nonpublic information for trades and required regular disclosure of those trades.” Burr argued that “insider trading laws already applied to members of Congress.”

In a public statement Friday morning, Burr rejected any claims of insider trading. “I relied solely on public news reports to guide my decision regarding the sale of stocks on February 13,” he stated. “Specifically, I closely followed CNBC’s daily health and science reporting our of its Asia bureaus at the time. Understanding the assumption many could make in hindsight however, I spoke this morning with the chairman of the Senate Ethics Committee and asked him to open a complete review of the matter with full transparency.”

Burr also rejected the characterization of his Tar Heel meeting as “‘secretive’ or ‘high-dollar donor’ organizations.” “They’re great civic institutions,” he claimed, “that bring people in D.C. together for events, receptions, and lunches. And they’re open to anyone who wants to get involved.”

Burr now faces calls to resign from lawmakers and pundits on both the left and right. Fox News host Tucker Carlson and Representative Alexandria Ocasio-Cortez (D-NY) have both called for his resignation.

Sen. Diane Feinstein

Senator Diane Feinstein also sold stocks ahead of the crash. According to the Times, Feinstein’s husband sold between $1.5 million and $6 million worth of stock in Allogene Therapeutics on January 31 and February 18. The stock has seen major drops since then.

Feinstein has claimed that she did not attend the January 24 Senate coronavirus briefing and that the sale of the company stock, which provides cancer treatment, was unrelated. Feinstein also clarified that all of her assets are held in a blind trust and that she has no input into her husband’s decisions.

Sen. James Inhofe

According to the Times, Senator Inhofe also sold a large amount of stock on January 27. His sales included $400,000 of stock in PayPal, Apple and Brookfield Asset Management, and a real estate company.

Inhofe has also stated that he was not present at the January 24 briefing and that he also has no involvement over his investment decisions.

“In December 2018,” he stated, “shortly after becoming chairman of the Senate Armed Services Committee, I instructed my financial advisor to move me out of all stocks and into mutual funds to avoid any appearance of controversy. My advisor has been doing so faithfully since that time and I am not aware of or consulted about any transactions.”

Inhofe was one of only eight Senators to vote against the COVID-19 relief bill passed wit bi-partisan support from Congress.

Sen. Kelly Loeffler

Senator Loeffler of Georgia did attend the January 24 briefing. She made the first sale of stocks jointly owned by her and her husband that have since fallen by more than 50 percent on the same day. The first sale was of stock in Resideo Technologies, which has since seen its share price cut in half. She made another 28 transactions after that—27 sales and two purchases. Sales include companies such as Exxon Mobil, Ross Stores, and AutoZone. In total, she dumped between $1,275,000 and $3,100,000 in stocks during that time period

The two purchases were of stock between $100,000 to $250,000 in Citrix, a technology company that provides teleworking software. While most other stock prices are dropping drastically, Citrix has seen a 5 percent bump in its price as a result of the coronavirus and work-from-home measures. Her other purchase was in Oracle, which has seen its stock decline 18 percent.

Loffler has stated that she had no knowledge of the sales and purchases until weeks later and that she does not manage her investments personally.

“This is a ridiculous and baseless attack,” she tweeted. “I do not make investment decisions for my portfolio. Investment decisions are made by multiple third-party advisors without my or my husband’s knowledge or involvement.

“As confirmed in the periodic transaction report to Senate Ethics, I was informed of these purchases and sales on February 16, 2020—three weeks after they were made.”

Loeffler is now also facing calls to resign.